Calculating return on investment real estate

For instance return on investment ROI measures returns as a function of appreciation or equity which can be tricky to apply to rental properties. Compelling riskreturn ratio for commercial real estate given low rates on 10-year government bonds.

How To Calculate Finance And Interest Costs On Your Investment Property Investing Investment Analysis Investment Property

The metric can be applied to anything from stocks real estate employees to even a sheep farm.

. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. Then we simply repeat the process discussed above by calculating our LP Required Return based on the beginning balance for this period then we calculate any new LP Contributions LP Distributions for this period and finally our Ending Balance and IRR check for this period. As its easy to understand that a 20 cash-on-cash return of a 100000 investment yields 20000 per year.

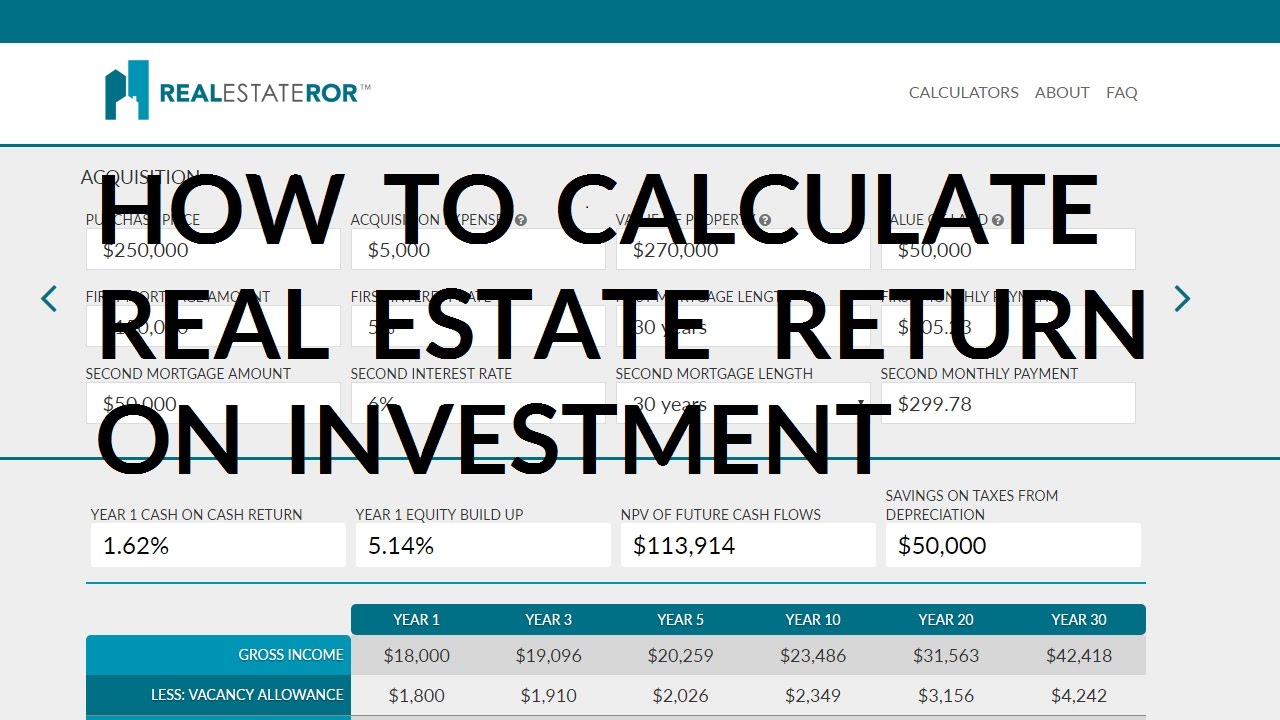

There are lots of different ways to measure your return on investment in real estate. Alternatives to the ROI Formula. From calculating cash-on-cash return to running a comparative market analysis the experts at BiggerPockets demonstrate the steps you need to follow and the statistics you must know with The Beginners Guide to Real Estate Market Analysis.

Real estate investing is not a get-rich-quick scheme and it can take decades before you see results. Change Date March 24 2011 41551 2A3a Definition. Real Estate Calculator Terms Definitions.

The formula for calculating cash on cash return is as follows. Two ways to answer this question are by calculating. Its seem like the ROE formula is the same as calculating your Cap Rate NOI market value.

In fact you can use it to calculate the returns on any type of investment. Take this course on its own or together with Financing and Loan Analysis of Investment Real Estate ASM603 and Asset Analysis of Investment Real Estate ASM605 with the Asset Management Track. In this case the net profit of the investment current value - cost would be 500 1500 - 1000 and the return on investment would be.

Return on Investment Example 3. Return on investment ROI is a metric that helps real estate investors evaluate whether they should buy an investment property and compare apples to apples one investment to another. Unlike the cap rate the IRR is a well-rounded way to estimate a real estate investments profitabilityBecause the IRR looks beyond the propertys net operating income and its purchase price which are used to calculate the cap rate you get a clearer picture of the kind of returns the investment will generate from start to finish.

Thats why real estate investment analysis is so important. ROI measures the amount of. Cash-on-Cash Return vs Capitalization Rate.

Cash flow is simply the money left after all the bills have been paid and appreciation is the equity gained as the property value increases. Cash On Cash Return Annual Cash Flow Initial Cash Outlay x 100. There are several primary factors to consider but cash flow and appreciation are the two most important variables.

In this case the ROI for Investment A is 500-100100 400 and the ROI for Investment B is 400-100100 300. The total investment amount for his portfolio is 750000. Properly calculate returns on your rental property investment.

Multi-Tier Real Estate Investment Waterfall Calculation Example. The REIT has delivered returns to unitholders by providing a superior investment opportunity on the basis of. There are many alternatives to the very generic return on investment ratio.

In this case the return on investment would be. To calculate your net profit subtract your stocks current value from the initial investment price. The formula for calculating real estate value based on discounted net operating income is.

Lets say you bought 5000 worth of stock in a. The most detailed measure of return is known as the Internal Rate of Return IRR. Anything that has a cost with the potential to derive gains from can have an ROI assigned to it.

Real estate 10 stocks 8 and bonds 2. I look forward to your reply or hearing from you. Investors commonly fail to incorporate rental income taxes insurance.

ROI allows investors to predict based on comparables the profit margin they should realize on their real estate either through flipping homes or renting properties. ROI net profit investment cost x 100. Investment diversification via exposure to selected European markets with a deeply experienced local asset manager.

Third parties on calculating the maximum mortgage amount including a definition of third party contribution interested third party contribution limitation payment of real estate commission and a reference for amounts exceeding the contribution limitation. Real estate investors will often debate which metric is more important. If youre completely new to real estate investing.

The capitalization rate is the rate of return on a real estate investment property based on the. Now that we have the return and weight of each investment we need to multiply these numbers. To calculate your ROI divide the net profit from your investment by the investments initial cost then multiply the total by 100 to get a percentage.

For real estate we will multiply 56 by. While much more intricate formulas exist to help calculate the rate of return on investments accurately ROI is lauded and still widely used due to its. Educate yourself invest wisely and design a strategic plan of action that includes real estate as part of your overall wealth plan here.

Return On Investment - ROI. Calculating the Return on Investment for both Investments A and B would give us an indication of which investment is better. This free Excel ROI calculator makes it easy for you.

Become a master at calculating effective rent comparing lease proposals and defining taxes related to real estate. Why Calculating IRR Is Useful. Cash-on-cash return or cap rate.

Each one has its pros and cons and tells you different things about your investment. In Johnnys portfolio the annual returns are. Real Estate Property consisting of land or buildings.

This is a measure of all the cash flow received over the life of an investment expressed as an annual percentage growth rate. A company spends 5000 on a marketing campaign and discovers that it increased revenue by 10000. If youre new to the real estate game it would be easy to.

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator

How To Analyze A Real Estate Investment Declutter Finance Rental Property Investment Real Estate Investing Real Estate Investing Rental Property

Return On Equity Roe Real Estate S Secret Formula For Success Return On Equity Buying Investment Property Real Estate Investing

Cash Flow Analysis Worksheet For Rental Property Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

Pin On Airbnb

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

How To Calculate Commercial Real Estate Investment Returns The Cauble Group Real Estate Investing Commercial Real Estate Investing

What Is A Good Return On Investment Investing Investment Property Real Estate

How To Calculate Roi On Rental Property Investments Homeunion Rental Property Investment Investment Property Rental Property

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

Rental Property Roi Cap Rate Calculator Real Estate Etsy Uk

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

Return On Equity Roe Real Estate S Secret Formula For Success

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

The 411 On Roi Morris Invest Real Estate Investing Real Estate Investing